Purpose

- Investigates the causes of economic imbalances.

- Investigates the effect of the global financial system and/or the monetary system in fostering a sustainable economy.

- Investigates causes tending to destroy or impair the free-market system.

- Explores and develops market-based solutions.

Summary

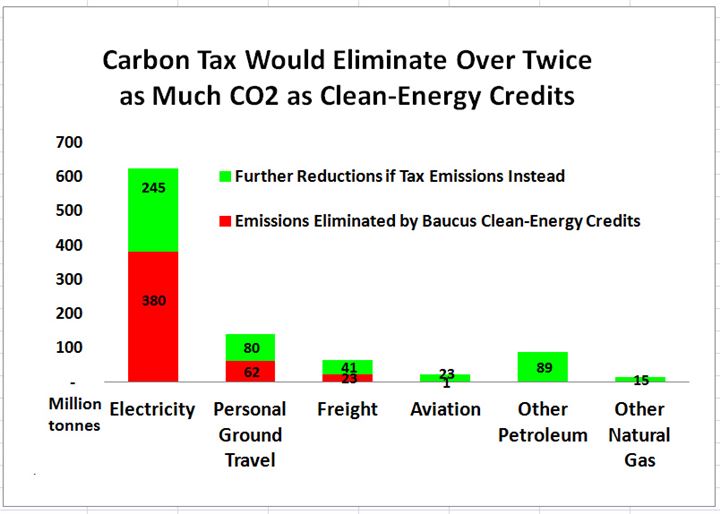

In January 2014, CCEC delivered to the U.S. Senate Finance Committee a report by the Carbon Tax Center demonstrating that a comprehensive U.S. carbon tax could cut U.S. CO2 emissions more than twice as fast as proposed clean-energy subsidies delivered as tax credits.

Description

The Senate Finance Committee's request for comments on the optimal design of energy fees (taxes), subsidies and rules pertaining to carbon pollution gave advocates for fiscal reform and climate protection a rare opportunity to position a carbon tax as both essential climate policy and a fiscally sound alternative to costly energy subsidies.

In January 2014, CCEC delivered to the U.S. Senate Finance Committee a report by the Carbon Tax Center demonstrating that a comprehensive U.S. carbon tax could cut U.S. CO2 emissions more than twice as fast as proposed clean-energy subsidies delivered as tax credits. The innovative 22-page analysis by CTC makes perhaps the most authoritative case yet for taxing fossil fuels’ carbon emissions directly rather than extending or maintaining subsidies to alternative low-carbon energy sources.

CTC summarized its report for CCEC in a blog post, through a news story by noted Reuters finance blogger Felix Salmon, and in a detailed profile of CTC director and report lead author Charles Komanoff in ClimateWire. CTC and CCEC are urging Senate Finance Committee staff to convene a fact-finding hearing for showcasing the fiscal, economic and climate benefits of carbon taxes vis-à-vis both subsidies and regulation.

The innovative 22-page analysis by CTC makes perhaps the most authoritative case yet for taxing fossil fuels’ carbon emissions directly rather than extending or maintaining subsidies to alternative low-carbon energy sources.

Purpose

(Investigate causes of economic imbalances): Our comments will quantify and emphasize the macroeconomic costs of both energy subsidies and failure to internalize climate damage from carbon emissions.

(Investigate effect of global financial system and/or monetary system in fostering a sustainable economy): Our comments will spell out ways in which a U.S. carbon tax can incentivize other countries to enact their own carbon taxes.

(Investigate causes tending to destroy or impair free-market system): Our comments will establish that energy subsidies are exacting large and growing costs on our market economy; and that the failure to include climate damage in the prices of fossil fuels is creating serious economic inefficiencies, with the consequences poised to grow steeply.

(Explore and develop market-based solutions): Our comments will place a market-based economic instrument -- a steadily rising carbon tax -- at the heart of both climate and tax policy.

Scope

CCEC will prepare and submit comments to the Senate Finance Committee, prepared by the Carbon Tax Center. They will call for:

• Phasing out energy subsidies;

• Phasing in a comprehensive and robustly rising carbon pollution tax;

• Recycling the revenues in ways that facilitate economic growth and protect lower-income households.

Our comments will spell out:

• Revenues provided by phasing out energy subsidies;

• Revenues provided by the carbon pollution tax;

• Likely range of carbon reductions from both measures;

• Why economic theory strongly favors our approach;

• Political advantages of our approach.

Our comments will be on the order of 15-20 pages, including a brief (2-page) executive summary. They will convey the idea of combining climate policy with fiscal and tax reform that Alex C. Walker Foundation trustee Barrett Walker enunciated powerfully at the Garrison Institute meeting in July 2011.

Amount Approved$5,000.00

on 1/17/2014

(Check sent: 1/31/2014)