Purpose

- Investigates the causes of economic imbalances.

- Investigates the effect of the global financial system and/or the monetary system in fostering a sustainable economy.

- Investigates causes tending to destroy or impair the free-market system.

- Explores and develops market-based solutions.

Summary

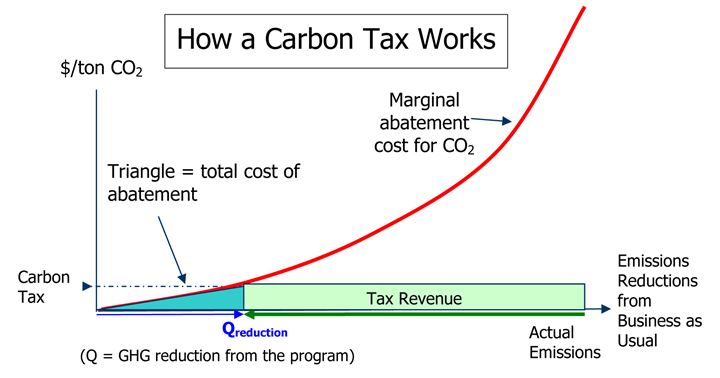

This project is part of the Brookings Carbon Tax Initiative and builds on earlier work supported by the Walker Foundation. In this project, Brookings scholars will analyze different ways to design a U.S. carbon tax in the context of fiscal reform. This work will involve new economic modeling with the G-Cubed model of the global economy, and it will explore a variety of carbon tax scenarios to elucidate the tradeoffs across different important design elements. In particular, the scholars will examine different carbon tax price levels and trajectories and different ways for the government to use the revenue, including reducing other taxes. The scenarios will investigate revenue-neutral approaches and the implications of advanced clean energy technology (including nuclear).

Description

This grant has supported ongoing research and outreach on carbon tax design. Dr. Morris has completed a comprehensive paper (coauthored with Aparna Mathur at the American Enterprise Institute) on carbon tax design, soon to be released under the auspices of the Center for Climate and Energy Solutions. The paper, entitled “A Carbon Tax in Broader U.S. Fiscal Reform: Design and Distributional Issues,” examines the issues and options for designing a carbon tax in the United States. It reviews the rationales for a carbon tax in the context of broader fiscal reform, explains the design issues, describes the potential revenue and environmental benefits, and explores options for using the revenue. Outreach for this work has included numerous meetings with Congressional staff in key committees.

Dr. Morris has also advised EPA on the design of upcoming rules to control carbon pollution from existing power plants. The recommendations (available here) explain the advantages of EPA allowing states to adopt state-level carbon excise taxes as an economically efficient means by which they can comply with their Clean Air Act requirements for greenhouse gas emissions. Outreach for this work includes a meeting with executive branch staff.

Drs. Morris and Mathur have recently completed a paper called “The Distributional Burden of a Carbon Tax: Evidence and Implications for Policy.” The paper will appear in a forthcoming volume called Carbon Taxes and Fiscal Reform: Key Issues Facing US Policy Makers, co-edited by Ian Parry, Adele Morris, and Roberton Williams.

Drs. Morris, McKibbin, and Wilcoxen have recently published a study comparing a carbon tax applied exclusively to the U.S. electricity sector and analogous carbon taxes applied broadly across the U.S. economy. The study is: “Pricing Carbon in the United States: A Model-Based Analysis of Power Sector Only Approaches,” with Warwick McKibbin and Peter Wilcoxen, Resource and Energy Economics 36 (2014), pp. 130-150.

Brookings scholars are also developing a new study under this grant support. The study will examine the costs associated with delaying GHG control measures and the economics associated with alternative policy approaches to make up for lost time. We have nearly completed the scenario design and are beginning the modeling work. A target date for an event to release the study has been set for the first week of June 2014.

Purpose

• This project investigates policies to address the market failure associated with climate changes.

• This project investigates solutions to foster a more sustainable economy, both fiscally and environmentally.

• This project explores how to incorporate the costs of environmental damage into prices and economic incentives, an inherently market-based approach, in lieu of command and control pollution regulation.

• This project focuses on the communication of the results and findings to policymakers, stakeholders, and the public.

Scope

The research will model U.S. carbon tax policy scenarios to estimate macroeconomic outcomes, effects on the composition of power generation technologies, and carbon tax revenues. It will also estimate the effect of these policies on carbon dioxide emissions from the energy sector in the United States.

Brookings scholars will present their findings in policy brief and a public event.

The study authors will invite comment at the event from representatives from organizations with an interest in pricing carbon. The goal will be to inform discussion on a carbon tax from a variety of stakeholders with an eye towards identifying common ground and promising ways forward.

Amount Approved$53,860.00

on 4/29/2013

(Check sent: 5/16/2013)