Purpose

- Investigates the causes of economic imbalances.

- Investigates causes tending to destroy or impair the free-market system.

- Explores and develops market-based solutions.

Summary

Green taxes involve increasing resource, land, and pollution taxes, and simultaneously decreasing taxes on productive items such as wages, income, and sales. They can also be used to pay dividends to the public. Green taxes create a market incentive for consumers and producers to choose a more environmentally clean product or service, thus fostering environmental accountability. The ultimate goal of this project is to provide detailed research materials and information to policymakers in Vermont in order to implement a green tax program for Vermont. Part of this project also includes development of a Vermont Common Assets Permanent Fund modeled after the Alaska Permanent Fund.

Description

Economic Efficiency

Taxes on income and capital, are generally considered inefficient for several reasons. “The most obvious cost is that Americans are left with less money to meet their needs for food, clothing, housing, and other items, and businesses are left with fewer funds to invest and build the economy. In addition, the tax system imposes large compliance burdens and ‘‘deadweight losses’’ on the economy. Compliance burdens are the time and administrative costs of dealing with the tax system’s rules and paperwork. Deadweight losses are created by taxes distorting the market economy by changing relative prices and altering the behavior of workers, investors, businesses, and entrepreneurs.” (Cato handbook on Policy 6th edition) Taxes on income and wages also increase the cost of labor to business, thereby decreasing the supply of jobs. This is true of income taxes, payroll taxes, and workers compensation payments.

Since “investment flees taxation” taxes on labor or capital also discourage innovation, job creation, and risk-taking. Taxes generally add to production costs, thereby raising prices and reducing consumption of the item taxed. For example, taxes on cigarettes, gasoline, or housing decrease consumption of these items by raising their price. While higher environmental taxes are often promoted by liberals for environmental reasons, conservatives often recommend lower income taxes. Many of the plans to reduce income taxes are combined with the suggestion to replace them with higher sales taxes. While this would decrease consumption, it is highly regressive, and only indirectly addresses resource consumption downstream. We feel that green taxes are a better alternative to replace income or payroll taxes, and more directly address environmental impacts resulting from resource consumption. A green tax shift can stimulate the economy and protect the environment at the same time, the holy grail of sustainable development.

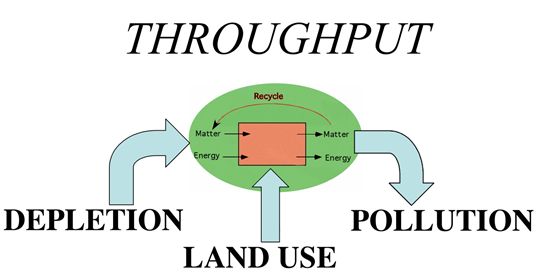

A Green tax is a tax on throughput. Throughput is the flow of resources and energy through the economy resulting in products as well as pollution and waste. Resource depletion , land use, and pollution are external costs which are not accounted for in market transactions. Standard economic indicators such as GDP, stock market level, housing starts, business profits, etc. provide no indication of social and environmental externalities. GDP, for example, measures the total dollar value of goods and services in the economy. Maximizing GDP therefore also maximizes throughput. Wouldn’t it make more sense to maximize GDP per unit of throughput? This would be an efficient economy rather than a wasteful one; smart growth instead of dumb growth. Failure to account for external costs in prices also violates the “polluter pays principle”. A green tax shift can begin to internalize some of these external costs and help make polluters pay. With green taxes resources will be conserved, land will be used more efficiently, pollution will be reduced, and production will be more efficient.

Taxing Throughput

Purpose

When market prices do not reflect environmental costs, polluting or depleting products are consumed in greater quantities due to under-pricing, and therefore society must pay for these external costs through taxation, regulation, lawsuits, health impacts, and other means. If prices include the true costs of products, many of these social costs can be avoided. Green taxes begin to include the true costs of depletion, land use, and pollution into the price of products, thereby correcting the imbalances in consumption that result otherwise.

Under the current system of not including external costs into the price of products, we are left with the alternative of command-and-control regulations in order to deal with environmental problems. This results in a lack of respect for the market system, since it unfairly rewards polluters and depleters of resources. If prices more accurately reflected and paid for environmental costs, there would be much less need for command-and-control regulations, and the market system would have much greater respect with regards to the environment.

Green taxes are a market based environmental solution which adds the cost of depletion, land use, and pollution into the price of products. Typically Green taxes are applied to energy, raw materials, land use, waste disposal, chemicals, air emissions, water emissions, etc. Additional revenue is often used to offset taxes on production, labor, wages, income, etc. which enhances the efficiency of the market economy by removing disincentives to productivity.

Scope

Green taxes in Vermont can serve as an example for state and national tax reform. At the forefront of environmental issues currently is the issue of climate change. There is no further scientific debate over the relationship of CO2 emissions to warming of the atmosphere, nor the contribution of humans to the problem through the combustion of fossil fuels. However, there is a very legitimate debate concerning what the impacts are and will be, and what measures to take. Many countries have chosen to participate in the Kyoto protocol concerning carbon emissions, and have begun measures to reduce their emissions. The US has not chosen to do so. However, several regions of the United States have developed their own Regional Greenhouse Gas Initiative (RGGI) including New England. This inititative calls for a cap and trade system on emissions from electric power plants, and sells permits for the emission of CO2. Some analysts believe that carbon will eventually become the most widely traded commodity, and there is already a voluntary Chicago Climate Exchange in addition to various carbon offset and green tag programs purchasing carbon credits. In Vermont 98% of carbon emission come from housing and transportation, only 2% from fossil-fueled power plants. Therefore the RGGI will have minimal impact on Vermont carbon emissions. Other measures such as carbon fees or taxes will be required to address 98% of Vermont carbon emissions. Many people are unaware that the Montreal protocol on CFCs originally set up a gradual phase-out of CFC before the magnitude of the problem forced an outright ban. One of the policy measures used to effect a phase out of CFCs was a tax on production of CFCs. In a similar way carbon or fossil-fuel energy taxes can begin to effect a gradual reduction of fossil fuel use through increasing prices. Other green taxes can be used to model a green tax shift off of productive activities onto depletion, land use, and pollution.

One of the largest threats to the global free-market system is the perception of unfairness due to the wide disparity in the distribution of wealth. This is leading to worldwide political instability and contributes to terrorism. Without some attention to this issue, continued global instability and criticism of the unfairness of capitalism will continue. One of the measures recommended recently by many political factions is the idea of an individual oil dividend in Iraq, Nigeria, or other oil rich country. In Nigeria for example, there is massive oil wealth, but the people are destitute due to corruption and exportation of most of the oil profits. The concept is often modeled after the Alaska Permanent Fund, which provides $1000-$2000 dividends to all Alaska citizens, and was orginated by Republican Governor Jay Hammond. As a result Alaska has the lowest disparity in wealth of any US state according to the US Census (gini coefficient). What about countries which don't have oil?

Establishing joint private property rights of the populace to natural resources and other common assets can prevent calls for redistribution schemes on earned income. Many other social and natural assets are the legitimate private property of the citizenry, and not the rightful property of corporations or other entities who have been given title by government. For example, the elecromagnetic spectrum is by law the property of the public in the US. But all the bandwidth has been sold or given to media companies. The public receives no royalties which are estimated to be worth $700 billion per year. The total value of common assets in Vermont is estimated to be $700 million/yr which translates to an annual dividend of $1000 for each person in Vermont.

Equal dividends such as this have a larger benefit proportionally to lower wage individuals and families than higher income people. This would be true worldwide, where individual dividends from common assets would help offset the disparity in wealth without distorting incentives, and could help reduce the corruption of governments.

Information Dissemination

Information has been disseminated through publications such as articles, manuals, web sites, press conferences, and possibly an upcoming book.

We contributed to the recent publication of "Tax Reform that Agrees With Vermont" published in January 2006. We completed a 45 page briefing book on Vermont Green Taxes for the legislature, and distributed an executive summary at a legislative briefing on January 25, 2006.

See: http://www.vnrc.org/article/view/9496/1/699

We hosted Dr. Anselm Gorres, Director of Green Budget Germany in October, 2006, for a legislative briefing, attended by several members of legislature, who have since authored some greentax bills including gas guzzler taxes and carbon taxes.

We held two days of briefings with Peter Barnes January, 2007. Peter testified at our invitation in the Vermont committee for Natural resources on how to implement the Regional Greenhouse gas initiative, including auctioning permits instead of granting them to industry. He also held a seminar at UVM on Capitalism 3.0 a new approach to using common assets to reform capitalism. As a result of this visit and our efforts a Common Assets Trust Fund Bill was introduced:

In January of this year, State Senator Hinda Miller of Chittenden County introduced S44, a Vermont “Common Assets Trust Fund” bill, based substantially on our recommendations, and in consultation with us. It includes a 25% per-capita dividend that we feel is crucial for sustaining public support, and for reducing economic inequality. This bill encompasses all of the natural and social commons, and creates a Board of Trustees to manage these resources. We plan to continue to work with Senator Miller to pass this bill, and to implement its provisions. If implemented this bill will require substantial technical assistance that we hope to provide. Senator Miller also introduced S147, and co-sponsored S35 with Virginia Lyons which are essentially higher taxes on gas guzzling cars.

Earlier this year Representative David Sharpe of Bristol requested our technical assistance in drafting a carbon tax bill H365. One of the cosponsors of this bill is newly elected Representative Rachel Weston, a former student in the Green Tax class of 2004, and research assistant on the green tax project. We plan to continue to provide technical assistance and briefings on the bill if necessary.

2007 Legislative Summary

Miller

Common Assets Trust Fund: S0044

http://www.leg.state.vt.us/database/status/summary.cfm?Bill=S%2E0044&Session=2008

S147-Gas Guzzler Tax

http://www.leg.state.vt.us/database/status/summary.cfm?Bill=S%2E0147&Session=2008

Lyons

S0035-Gas Guzzler Tax

http://www.leg.state.vt.us/database/status/summary.cfm?Bill=S%2E0035&Session=2008

Sharpe-Weston

H365-Creation of a Carbon Tax

http://www.leg.state.vt.us/database/status/summary.cfm?Bill=H%2E0365&Session=2008

We are briefing groups of all political persuasions such as the Fair Tax Coalition, Vermont Forum on Sprawl, Ethan Allen Institute, Republican Party, Democratic Party, Progressive Party, Vermont Natural Resources Council, VPIRG, Vermont Businesses for Social Responsibility, etc.

Project Link http://www.uvm.edu/giee/?Page=research/greentax/index.html

Amount Approved$10,000.00

on 11/30/2005

(Check sent: 12/12/2005)