Purpose

- Investigates the causes of economic imbalances.

- Investigates causes tending to destroy or impair the free-market system.

Summary

We conducted twenty decision-making experiments in which 345 undergraduate students and 55 adult subjects participated. Subjects were assigned unequal pre-tax incomes mirroring the distribution of income in the United States, then made decisions about the extent, if any, to which incomes should be redistributed by taxation, under varying tax costs, degrees of efficiency and incentive (administrative) costs, and determinants of initial income. Results suggest willingness to pay to lessen inequality among other individuals, but largely self-interested voting when own income is at stake.

Students participate in the decision-making experiment in a computer lab.

Description

A team of experimental economics researchers at Brown University, led by Professor Louis Putterman, carried out a decision-making experiment in order to study the reasons why income is redistributed toward poorer individuals and households in high-income democratic countries. In particular, we sought evidence regarding the presence and strength of disinterested desires that "society" should have a more equal distribution of income, versus the strength of the tendency to vote to redistribute income when it raises one's own personal earnings.

345 Brown University undergraduates, drawn from all subject areas, participated in sixteen experiment sessions, each taking slightly under two hours. 55 adult subjects participated in four other sessions designed to test whether student choices can be generalized to the population as a whole. Most sessions were conducted in 2004 and early 2005, with a few more in late 2005. Each subject submitted decisions about how $500 would be divided up among twenty other participants, knowing that each had an equal chance of being the sole decider of this matter once one of twenty-one ID numbers was drawn from a hat. Each subject submitted at least eight separate tax choices, under four alternative ways of determining which participants would receive high versus low incomes, and under two conditions. The conditions were (1) tax and redistribution affect the other twenty participants in a session but not oneself; (2) tax and redistribution affect twenty participants including oneself. The income-determining methods included two interpretable as merit-based--deciding income rank by performance on a general knowledge quiz or play of a skill-based computer game--and two more arbitrary methods--deciding income rank randomly, and having it determined by the income of one's parents (student subjects) or one's own annual income (adult subjects). In most of the experiment sessions, imposing taxes that redistributed earnings was costly and costlier the higher the tax. Four different tax costs were used in order to identify a demand curve (willingness to pay) for taxation. In some sessions, there was also a direct efficiency penaty for taxation: the total available to distribute went down by one eighth or by one fourth as money passed through the tax system, mimicking administrative and incentive costs of redistributive taxation. As expected, the results showed that the desire to reduce inequality in the distribution of earnings responded normally to economic costs: the higher the cost paid by the decision-maker for each increment of taxation or the higher the efficiency loss to the (experimental) society, the lower the tax that the decision-maker tended to select.

The results indicated a substantial willingness to pay for some equalization of earnings among other participants, when the decision-maker himself/herself was not directly affected. For example, a substantial number of subjects were willing to give up $10 out of about $25 of expected earnings from their participation in the experiment in order to make earnings among twenty other subjects (whom they did not know before the experiment) more equal, especially when inequality would have been determined randomly or according to family socioeconomic background. This result did not change dramatically when adult subjects were the participants, even though there was disproportionate representation of unemployed and underemployed individuals who were attracted to the experiment mainly by the opportunity to earn some money.

However, the results also show that when the decision-maker is one of those directed affected by the degree of redistribution, choices of taxation levels tend to be self-interested, with the influence of "social preferences" being relatively small.

Put together, these results suggest that a more equal distribution of income than the one generated by market processes is a genuinely "public good" that is perceived favorably by most individuals, but that electoral outcomes supportive of redistributive taxation and social programs might still be mainly explained by the self-interest of voters, the large majority of whom pay much less than the average per person amount of taxes since the top few percent of income earners account for a considerable share of tax revenues.

Attitudes towards political issues were elicited by questionnaire at the end of the experiment sessions, and the expressed attitudes have turned out to be correlated with individuals' choices about redistributive taxation in such a way as to give confidence that the experimental decisions are valid indicators of policy preference. The experiment is unique, however, in that subjects were not simply answering questions about their views, without monetary opportunity cost, but were making decisions determining the distribution of a substantial sum of money to themselves and others.

Due to the large body of data collected, analysis is still in progress a year after most of the experiments were completed. A research paper is in progress and will have its first presentation at a seminar at Brown University in November, 2006.

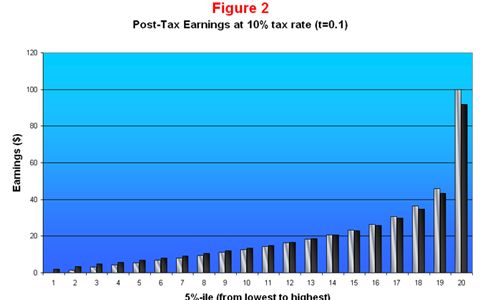

Sample instruction screen from the experiment, with a graph comparing the final earnings of participants 1 through 20 in the absence of taxation and redistribution (silver bars) and their earnings if 10% of pre-tax earnings are taxed and redistributed (black bars)

Purpose

Income differences have been widening in the world's advanced economies since the 1980s. This project doesn't investigate the reasons for that trend, but rather the determinants of the counter-vailing force of redistributive taxation, for which there has continued to be a demand despite the slowing in the sizes of most welfare states. There is, on the one hand, the concern that too much redistribution through the fiscal system dampens incentives to invest in physical assets and in skills. On the other hand, there are concerns that excessive inequality of market outcomes will itself undermine support for the market system, or could give rise to forces undermining political stability. A clearer understanding of the forces underpinning redistributive taxation and expenditure should help to give economists and policy-makers a better understanding, with the possibility of (a) responding to those forces in more efficient ways, and (b) understanding when and to what extent redistribution increases social well-being on balance. Since the study of these matters (especially by the experimental method) is still in its infancy, actual policy proposals are not expected to result from this stage of the project.

Scope

Redistribution as a counter-force to the widening inequalities observed in recent years can be seen in alternative manners, either as constraining the full vigor of the market economy, or as leading to improved social well-being and to keeping in check potential pressures to constrain free markets. The present project can be seen as a pilot study to apply the method of experimental economics to this question of fundamental significance to the health of the economy.

Information Dissemination

An academic paper summarizing the results of the research is now in preparation. After initial university presentations, a version will be submitted for publication in a peer-reviewed journal of economics. A more popular summary will then be prepared for distribution in forums as yet to be determined.

Initial Paper Reporting Study Results

Amount Approved$15,000.00

on 6/30/2004

(Check sent: 7/6/2004)