Purpose

- Investigates the causes of economic imbalances.

- Investigates the effect of the global financial system and/or the monetary system in fostering a sustainable economy.

- Explores and develops market-based solutions.

Summary

This two part project is in Phase II consisting of the following three tasks: 1) Quantifying the economic value of selected ecosystem service benefits associated with conserving red wolf habitat, including carbon storage on agricultural and undeveloped lands; 2) quantifying the economic value of open space property value premiums and recreation; 3) conducting a cash flow analysis associated with the provision of these services from private agricultural lands, and identifying and promoting policy proposals for the implementation of market-based incentives that link protection of red wolf habitat to national or state resource conservation programs.

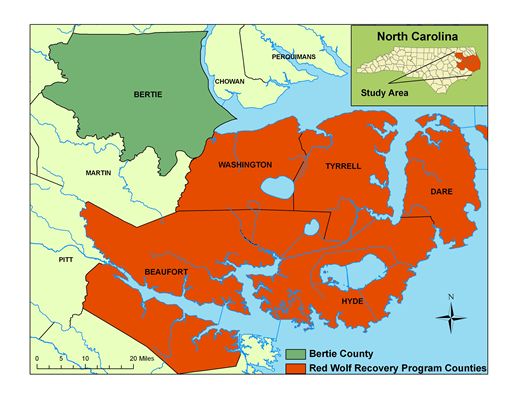

There are two survey treatments within the ecosystem payment study area, red wolf counties (Dare, Beaufort, Washington, Hyde, and Tyrrell) and non-red wolf county (Bertie)

Description

This report presents the preliminary results of the first three tasks outlined above. The 2008 Farm Bill took a first step toward encouraging farm operator participation in emerging markets for ecosystem services. Guidelines are being developed to inform new ways to provide payments for ecosystem services and the research, policy, and outreach tasks described below will help inform this process. The results of all tasks will be disseminated and discussed with local landowners, communities, state agencies, conservation groups, and private ecosystem market entities.

Task 1. The approximately 1.2 million acres of undeveloped and nonagricultural lands in the five-county study area represent a sizeable carbon sink. Landowners whose property provides red wolf habitat can benefit from carbon sequestration through several of the emerging and proposed regional and national carbon markets. These markets allow landowners to receive carbon offset payments for these sequestration services, provided certain conditions are met.

Currently, the Chicago Climate Exchange (CCX) is the only organized carbon offset market to which landowners in the study area have access. The CCX defines “sustainable managed forestry projects” as forestry operation whose growth in carbon stocks exceeds harvest volumes. In general, the forest lands in our study area do not qualify for offset generation under the CCX’s Sustainable Managed Forest Offset Project protocol since harvests exceed net growth. On average, during 1990-1999, the study area forest harvests exceeded net growth by 21%. This result will vary for individual lots, of course, and land owners who decide to stop timber extraction from their forests on average could generate an estimated 220 tons of CO2 net sequestration per acres over 100 years in the case of conifers, the land cover type for many plantations in North Carolina. At current (March 2010) CCX carbon prices of 10 cents per ton of CO2 this would be negligible earnings and only if prices rose between $20 or $30 per ton would prices be relatively competitive with forestry. In addition, at least currently, the CCX would not accept this kind of project, as only former forest land that has been in non-forest use for at least ten years is eligible for generating afforestation offsets.

In addition to the CCX, voluntary “over-the-counter” (OTC) markets handle deal-by-deal transactions of more tailored offsets than those that take place in the CCX. OTC markets accept afforestation and reforestation credits as well as credits from many other projects (Hamilton et al., 2009). In 2008, the U.S. was home to the majority of OTC afforestation and reforestation projects worldwide (ibid.). The volume-weighted average OTC prices in 2008 for forest-related projects in the U.S. ranged from $6.3-7.7 per ton of CO2e (Table 1.1)

Thus, currently, private landowners should be able to generate higher income from OTC projects compared to registering their project with the CCX. It is important to note that in some cases afforestation and avoided deforestation offset revenue in itself is not competitive with forestry, combining earnings from other compatible uses such as hunting leases and perhaps water quality might add sufficient additional revenue to make land conservation or restoration, including red wolf habitat, competitive with timber production.

Task 2. Conservation of red wolf habitat also can provide recreational opportunities. These opportunities may not be the primary focus of red wolf habitat conservation, but are a joint product of the conservation effort. The recreation activities practiced on red wolf conservation lands have economic value. Part of this value is reflected in market transactions in the form of recreationists’ trip expenditures. The remainder of the value accrues to participants as consumer surplus or net benefit.

Conservation of red wolf habitat also generates open space-related value premiums for residential properties in the vicinity of the natural lands. Table 2.1 presents the aggregate open space premiums for each of the five counties in our study area. These results show that in 2009, the total residential property value premium in our study area attributable to forests and grasslands was estimated at approximately $50 million (2009$).

The size of the total open space premium received in each county ranges considerably as a function of the number and value of properties in each county, from an estimated $1.5 million in Hyde County, to an estimated 40 million in Beaufort County (Table 2.1). Since open space premiums are reflected in property values, they form part of the assessed property value. With average property tax rates in the four counties included in our estimation (with Dare County excluded because all open spaces were wetlands) of around one percent (North Carolina Department of Revenue, 2009), the open space in the study area contributes an estimated $500,000 per year to property tax revenues.

It bears emphasizing that the open space value of natural lands is only a portion of the total economic value these lands generate, namely, the amenity value homeowners place on scenic views and on easy access to green areas. Natural lands provide a multitude of additional benefits, from habitat for fishable, huntable and viewable wildlife and threatened, endangered and rare species, to water quality and carbon sequestration, to name but a few. This is also true for wetlands (Bin and Polasky, 2005), which we assumed did not generate property value premiums because of the findings of another study carried out in the same region of the state (ibid.)

Task 3. In this part of the project, we are investigating the possibilities for and essential policy elements of conserving red wolf habitat through market-type incentives, including markets for ecosystem services. Our work on the cash flow analysis of ecosystem services began with identification of two representative farms within the study area. Farm A, representing farms west of highway 32, consists of 500 acres, with 60% in field crops and 25% in planted forest for timber. Representative of farms that are located east of highway 32, Farm B is 1000 acres, with 75% used for crop production and 12.5% in planted forest. Results from the cash flow modeling are shown in Figure 3.1. In addition to the baseline for each farm, results are presented for a low and high conservation scenario and for a low and high carbon scenario.

The baseline (BAU) NPV is $1486 per acre for Farm A and $1653 for Farm B. Under the low conservation scenario, there is little change in income since the CRP payments are mostly offset by the lost crop income from taking land out of production. However, under the high conservation scenario, NPV increases by $193 per acre (13%) on Farm A and almost 8% on Farm B. This boost owes to the high, upfront (undiscounted) payments from WRP. These payments are higher for coastal plain farmland and thus benefit Farm A more than Farm B.

Next we consider the carbon payment scenarios. A low carbon price of $5 per tonne CO2 means lower returns than the baseline for Farm B and basically equivalent returns for Farm A. At this low price, afforesting 15% of one’s cropland earns less per acre than the crops previously planted. There is some additional income from soil carbon-generated credits from no-till, but not enough to offset the opportunity cost of taking some land out of production to plant trees. For each farm, the high carbon price scenario ($30/tCO2e) generates the highest NPV/acre out of all the scenarios. It represents 14% and 12% gains above the baseline discounted returns for Farm A and B respectively. For Farm A, the returns in the high carbon scenario are comparable to the scenario that emphasizes conservation program enrollment (CRP, NC Ag Cost Share, and WRP), while high carbon is clearly the most attractive scenario for Farm B.

Overall, the impacts of conservation program enrollment and carbon market participation are relatively similar across the two farms, though few farms would shift to “grow carbon” if the carbon price were relatively low. From an income perspective, although the high conservation and high carbon market scenarios dominate the other options, other factors may also be important to landowners’ land management decision process. These include concerns about government restrictions, changing land management practices, unnecessary paperwork and requirements, or low payment levels.

Purpose

This project is innovative in the sense that it takes a new concept, payments for ecosystem services, and applies it to a specific species and habitat. The purposes selected will be addressed by identifying mechanisms in which rural landowners can capture the benefits of conserving red wolf habitat, and will thereby achieve two national public goals: (1) rural areas are in better economic balance with other parts of the country; and (2) protecting the red wolf through market mechanisms can illustrate the potential benefits of monetizing environmental goods within a regulatory framework.

Scope

Although specific to red wolves in North Carolina, this project could serve as a model for similar efforts on a nationwide scale. Thus, the impact of the project can be applied broadly for an issue of national importance: the conservation and protection of at-risk species in the context of sustainable rural economies.

We believe this project will have lasting value not only from the standpoint of securing revenues for landowners to protect red wolves, but also for serving as a model for similar projects in other areas of the U.S. Because payments for protecting red wolf habitat constitute more or less a permanent market, funds for continued habitat conservation will be generated through a combination of future public funding, but more extensively by securing funds from the private market for the ecosystem services being supplied.

Amount Approved$42,000.00

on 12/15/2008

(Check sent: 12/22/2008)