Purpose

- Investigates the causes of economic imbalances.

- Investigates the effect of the global financial system and/or the monetary system in fostering a sustainable economy.

- Investigates causes tending to destroy or impair the free-market system.

- Explores and develops market-based solutions.

Summary

The Vermont Green Tax and Common Assets Project researches, educates and disseminates information on recovery of unearned income from common assets such as the monetary system, speculation, land, minerals, spectrum and other resources. In addition we investigate green taxes on throughput including depletion, land use, and pollution, which are ignored by market economics.

These sources of income are a better alternative to taxing productive activities such as income, wages, excise, sales and building construction that create disincentives to productivity. By taking the profit out of speculation in finance, land, and natural resources, investment is directed towards real production and real goods. Additionally, we investigate the feasibility of redirecting some income from common assets to citizens in the form of a dividend, similar to the Alaska Permanent Fund annual dividend which contributes to Alaska’s standing as the state with the lowest level of wealth inequality in the U.S.

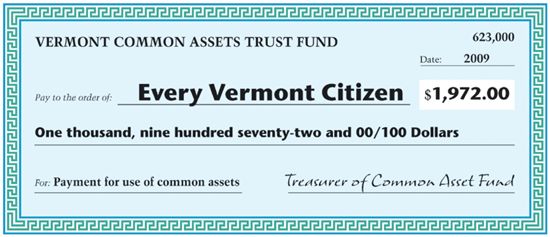

Estimated dividend paid to Vermont citizens if the Common Assets and Trust Fund is implemented.

Description

Legislative Progress

So far this year we have made significant progress with the Vermont legislature. Project manager Gary Flomenhoft was invited to testify three times to the Legislature. Due to the financial crisis and $150 million shortfall in revenue the state established a “Blue Ribbon Tax Structure Commission” to evaluate changes to the Vermont tax system. Information can be found at:

http://www.leg.state.vt.us/JFO/Tax%20Commission.htm. Flomenhoft briefed the commission on all the prior research performed by the project so far on green taxes and common assets. Testimony can be found on the Tax commission website under December 8, 2010. The commission issued its interim report but only dealt with questions about the adjusted gross income question. The Commission asked Flomenhoft to submit a revised green tax plan for the state, which he submitted in January.

Next Flomenhoft was invited to the Senate Finance Committee for a 1-½ hour briefing on the topics of how to reform the revenue system of the state. They were given a detailed briefing on green taxes and common assets, as well as recommendations for Tobin taxes on financial speculation, and formation of a state bank similar to the Bank of North Dakota.

Flomenhoft was then invited back to the House Ways and Means committee for the second time, this time for testimony on the fee bill relating to fees on groundwater extraction for bottled water. He was provided an hour to make a case for charging royalties for groundwater when used for bottled water. It is noteworthy that bottled water sells for $6.78/gallon compared to $1.83 for a gallon of crude oil. So bottled water sells for over 3.5 times the price of oil, but bottlers pay nothing to extract water.

Bills Proposed

Last fall we provided a briefing to Senator Hinda Miller and legislative council Dan Paradis on issues relating to viability of common assets legislation. We chose to focus on groundwater as a target for revenue. They adopted the principle of “tax bads, not goods” by proposing to eliminate the sales tax exemption for candy and bottled water. They proposed to use the principle of “pay for what you take, not for what you make” with a 12c fee on bottled water, while reducing capital gains taxes that had been increased last year. This would presumably stimulate the local economy, assuming they were based on productive investments. The bill proposed was Senate Bill 256. Title: AN ACT RELATING TO THE TAXATION OF CAPITAL GAINS, TAXES ON SOFT DRINKS, CANDY, AND BOTTLED WATER, AND A GROUNDWATER WITHDRAWAL ROYALTY. It is still in committee.

On February 12, the House Ways and Means Committee passed a measure in the fee bill, increasing the discharge fee on Vermont Yankee nuclear power plant by a factor of 7, from $27,500 to $210,000 a year. The natural resource committee considered raising it to $500,000. This demonstrated the principle of taxing pollution. Two weeks later the Senate voted to shut down Vermont Yankee.

Publications

VT Commons Journal is publishing a series of articles we are writing about the Vermont common assets study conducted by our project in 2008. Substantial new research and editing is being done on these articles. Journal can be found at: http://www.vtcommons.org/journal

An article about our Tax Structure Commission testimony appeared on 12-09-2009 in the Times-Argus Newspaper entitled: “UVM Institute Suggests Radical Overhaul of VT Taxes”:

http://www.timesargus.com/

The Burlington Free Press Newspaper published an article by Gary Flomenhoft on July 9, 2009 entitled: My Turn: Reclaim Vermont's resource sovereignty http://www.burlingtonfreepress.com/article/20090701/OPINION/90709031

Karl Widerquist of the US Basic Income Group (http://www.usbig.net) has a contract to publish a book on basic income using resource rents. He has requested a book chapter on Vermont from us.

The 2004 Green tax Report was revised and printed in a glossy booklet form for distribution. See:

http://www.uvm.edu/giee/?Page=research/greentax/greentax.html

Issues

Climate Change

In our revised green tax plan to the Tax Structure Commission we recommended a $20/ton carbon tax combined with a $271 per capita rebate to mitigate the effect on rural commuters who need to drive to jobs. Our energy plan simplifies taxation of energy resources and would shift energy sources away from fossil fuels.

Groundwater

In our testimony to the House Ways and Means Committee we advocated charging rent to bottled water companies for their free extraction of groundwater. We provided background materials for a Senate bill (S.256) charging bottlers 12c/gallon, and supported the fee bill of 1c/gallon, while advocating a much higher amount of 12%.

Forests

To deal with the conversion of forestland to housing developments we have suggested revising the current use penalty, which doesn’t recapture the lost tax revenue when forests are converted to housing.

Loss of biodiversity/sprawl

Our work in this area has focused on land value tax shifting at the municipal level, especially for growth Centers, Downtowns, and village Centers. After discussion with the Director of Programs at Smart Growth Vermont, we recently arranged to give a keynote presentation to the organization of Vermont “Downtowns.” This will take place in March or later in the spring. This tool if used in the designated downtown and growth center districts would spur density and avoid sprawl.

Inequality and Privatization of the Commons

We have continued to advocate for collection of rent on common assets and resources of the state and to create a “sovereign wealth fund” paying dividends to residents of Vermont. We made this recommendation to the House Ways and Means Committee in 2009 and the Senate Finance and Tax Commission in 2010.

Future plans: Graduate Assistant, curriculum, and outreach

We expect to hire a ½ time graduate assistant this spring with additional grant funds obtained from other sources. We have printed 500 copies of our green tax shift plan for Vermont and plan to distribute them this spring to the media and Vermont organizations and provide briefings on the topic. We have also scheduled a graduate course in Public Administration this fall on environmental subsidy reform, which is the final topic we have not researched for public finance in the state of Vermont. Upon completion of the research we plan to publish a third report in a readable, popular format and provide testimony to the state on this approach.

Summary

We are becoming more effective in public policy debates, and have had numerous invitations to testify for legislative committees. We have published most of our research work that has been complete so far in readable glossy booklets. We are extremely grateful for your support, which has allowed us to make this recent progress in influencing public policy.

Purpose

When market prices do not reflect environmental costs, polluting or depleting products are consumed in greater quantities, and society must pay for these costs through taxation, regulation, lawsuits, health impacts, and other means. Green taxes and common asset fees are market-based solutions that include the true costs of depletion, land use, and pollution into the price of products, thereby correcting imbalances in consumption that result.

The fractional reserve monetary system which allows commercial banks to create 93% of the money with interest, inevitably requires an unsustainable infinite growth economy. We are investigating 100% reserve requirements and using seigniorage to serve the interests of the public. The financial meltdown has exposed how the use of money and land as speculative commodities resulted in near destruction of the free-market economy. Removing the financial incentives for speculation is one of our purposes.

Scope

This project addresses climate change, peak oil, financial system instability, speculation and many issues of national importance. States are the laboratories of democracy, and Vermont has pioneered many policies such as the Regional Greenhouse Gas Initiative (RGGI) and our unique electrical efficiency utility, Efficiency Vermont. Green taxes and common assets have powerful implications for environmental enhancement, economic stability, and reduction of wealth inequality. Our program will compel inherently polluting and depleting industries to compensate Vermont citizens for the loss of ecological quality. This compensation could provide a base income for every Vermonter, helping to insulate them from events such as an economic downturn. Business will also benefit if a portion of these revenues replaces payroll taxes and other regressive taxes. If successful, this project will demonstrate to the rest of the nation and the world the power of ecological market mechanisms.

Information Dissemination

We have testified to the state legislature including the House Ways and Means Committee. We publish reports, articles in local and regional publications, as well as academic journal articles.

Project Link http://www.uvm.edu/giee/?Page=research/greentax/greentax.html

Amount Approved$25,000.00

on 6/24/2009

(Check sent: 7/24/2009)